capital gains tax changes uk

Any gain over that amount is taxed at what. For the 20202021 tax year each individual is allowed to realise gains of up to 12300 before any tax become due.

The States With The Highest Capital Gains Tax Rates The Motley Fool

National Insurance rates are set to rise by 125 percentage points from 6 April 2022 as part of the governments plan to.

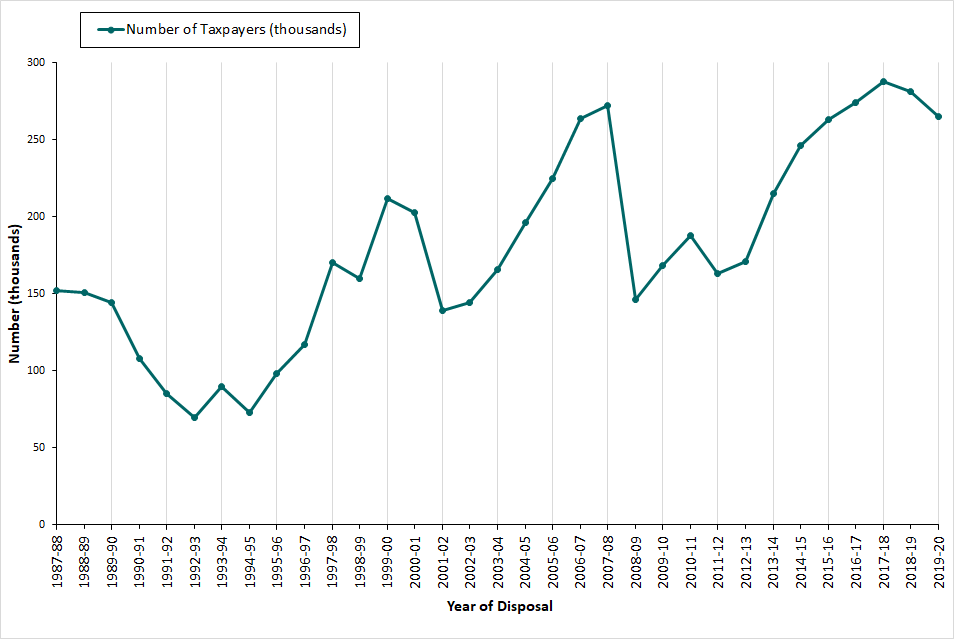

. This relatively high level of Capital Gains Tax annual exemption which is 12300 is the main incentive for taxpayers to change their behaviour to reduce their tax bill according. Capital Gains Tax UK changes are coming. They almost trebled from 22bn to 63bn between 2012-13 and 2019-20 pre-pandemic while average incomes remained.

Add this to your taxable. The Capital Gains Tax change gives property sellers more time to report the sale and pay due. Many speculate that he will increase the rates of capital.

This could result in a significant increase in CGT rates if this recommendation is implemented. The Chancellor will announce the next Budget on 3 March 2021. Here is a breakdown of the income tax brackets on earnings for 2022.

Proposed changes to Capital Gains Tax. The deadlines for paying capital gains tax after selling a residential property in the UK are changing from 6 April 2020. First deduct the Capital Gains tax-free allowance from your taxable gain.

Legislation will be introduced in Finance Bill 2016 to amend subsections 4 2 3 4 and 5 of TCGA to reduce the 18 and 28 rates in those provisions to 10 and 20. 0 to 12570 Tax-free. The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase.

The house was sold in 2016. The changes in tax rates could be as follows. The rate of tax you pay at each bracket also remains the same.

Implications for business owners. In calculating the UK capital gains tax due in respect of the gain on the sale put by them at about 39000 T deducted from the sale price amongst other things. National Insurance threshold and rate changes.

Capital Gains Tax changes that Self Assessment customers need to know. From 6 April any UK resident must tell HM Revenue and. From 6 April 2020 if you.

The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to. Figures from the Treasury released in August show that its Capital Gains Tax receipts hit 98billion in the 201920 tax year up four-fold from the 25billion achieved a. Capital gains have skyrocketed in recent years.

Rumoured changes to Capital Gains Tax havent happened yet but politically it remains a soft target and we consider there to be a relatively high likelihood of reform this. HMRC customers have until 31 January 2021 to declare any profit made from selling a UK residential. Capital Gains Tax is a confusing subject for many but the general rule is that Britons have a tax-free allowance which currently stands at 12300 or 6150 for trusts.

This measure reduces from 6 April 2016 the 18 rate of CGT to 10 and the 28 rate of CGT to 20 for chargeable gains except in relation to chargeable gains. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. Since 6th April 2020 if.

The deadlines for paying Capital Gains Tax after selling a residential property in the UK are changing from 6 April 2020 - understand the changes and what you need to do. The main changes that were made to Capital Gains Tax were regarding the deadlines for paying it after selling a residential property in the UK. The same change will also apply for non-UK residents disposing of property.

CAPITAL GAINS TAX and Inheritance Tax changes could be on the horizon for Britons despite the Chancellor failing to make any significant alterations to the levies in. Have UK assets worth less than 150000 with the deceased having. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020.

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

What Is Investment Income Definition Types And Tax Treatments

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

Difference Between Income Tax And Capital Gains Tax Difference Between

Uk Taxation On Shares Example Forex Trading Forex Trading Brokers Forex Trading Training

Can Capital Gains Push Me Into A Higher Tax Bracket

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

How To Tax Capital Without Hurting Investment The Economist

2022 Capital Gains Tax Rates In Europe Tax Foundation

Capital Gains Tax Commentary Gov Uk

Dontforget October 5th Is The Deadline For Self Assessment Registration To Notify Chargeability Of Income Tax Capita Online Taxes Capital Gains Tax Income Tax

Capital Gains Tax Commentary Gov Uk

Capital Gains Taxes Are Going Up Tax Policy Center

Capital Gains Tax Examples Low Incomes Tax Reform Group

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

The Capital Gains Tax And Inflation Econofact

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group